HealthManagement, Volume 16 - Issue 3, 2016

CAN GE HEALTHCARE AND SIEMENS COMPETE WITH HOLOGIC?

Although the report is focused only on the U.S. market, is the outcome indicative of a worldwide trend?

We have not had deep discussions outside of the US so I am not able to speak about the worldwide situation. As a side note, there was adoption earlier for GE & Siemens outside of the US because they did not have to go through FDA, which is what slowed adoption down here.

Have you also calculated a cost-benefit ratio, or is it based purely on practical use?

We did not calculate a cost-benefit ratio because of the variety of payment and reimbursement. It may be of interest to you to note Centres for Medicare & Medicaid Services (CMS) does reimburse for Tomo. This was not the case in the past. The mix still consists of insurance and payers.

You mentioned “key differences among vendors in regard to implementation, development, and relationships”. Can you elaborate?

Hologic had a head start in the U.S. because they were FDA -approved early in the game. Breast imaging/ women’s health is also their niche so they have really nailed it down. This includes implementations, development and building relationships with the right people. As it is their world, they are deeply involved with decision makers as well as the departmental heads and are also communicating with the technologists within the women’s imaging departments and breast centres. They have deep roots within an organisation.

You mentioned the advantages/challenges of upgrades. On the cost issue again, are consumer/buyers factoring in this cost, calculating the longer-term benefits, or do they need efficient results today?

On the consumer end, we do hear about this being handled two ways. Some providers are adding in the Tomo and not charging the patient and others are offering it as an additional service for a fee. There is a range but those who are changing have told us on average it is around 50 dollars per exam.

In most cases where patients are given the option, we have had providers tell us it is well received and many patients choose to pay the additional cost to add Tomo. Of course there are areas where this is not the case, but overall we hear from providers it is well received.

We have also heard from many providers that they added Tomo because they were losing business to others who did offer the 3D technology. It is a technology that consumers are aware of and it can determine where a patient chooses to get their mammogram.

In other areas, we have seen healthcare organizations buy second-hand equipment, making a cost-saving in the short-term, only to discover lack of compatibility or software upgrades at a later stage. Do you care to comment on this?

We have not seen this in Tomo because it is so new. A unit has to be Tomo-ready in order to be capable to be upgraded from 2D to 3D. Not all 2D units can be upgraded to do Tomo.

Both GE and Siemens have a legacy of a widely diverse industrial colossus backing their healthcare sectors. Would you say that Hologic is a modern-day Hercules or is it a case of David and Goliath? Did this also work to Hologic’s advantage, in that it has been more focused on its activities, as opposed to GE that builds a range of products from fridges to space satellites, while Siemens makes cell-phones to high-speed trains?

We don’t hear providers mention GE or Siemens in other spaces. Both companies are known for cutting-edge technology in the medical equipment space. They are however having to play catch up a little in breast imaging.

Alternatively, is Hologic’s advantage due to its headstart only, whereby, other equipment makers will soon catch-up?

Hologic definitely had a big head-start. However, their customers also give them credit for excellent customer service and communication. Providers/ customers also appreciate the investment Hologic has made in this market. While a handful of customer talk about Hologic sticking to their guns on pricing, they also recognise Hologic has made a large investment in the industry so providers appreciate the advancements being made. It is often mentioned that Hologic has been a leader and helped raise the bar. We have also started to hear positive things from the early adopters who have GE and Siemens. It will be fun to see what happens in this market. Hologic has raised the bar but the other vendors seem to be up for the challenge.

From the responses for your survey, is there an indication of what future needs are being imposed on equipment makers? Any indication where we are going in this area (Tomo and other breast-imaging)?

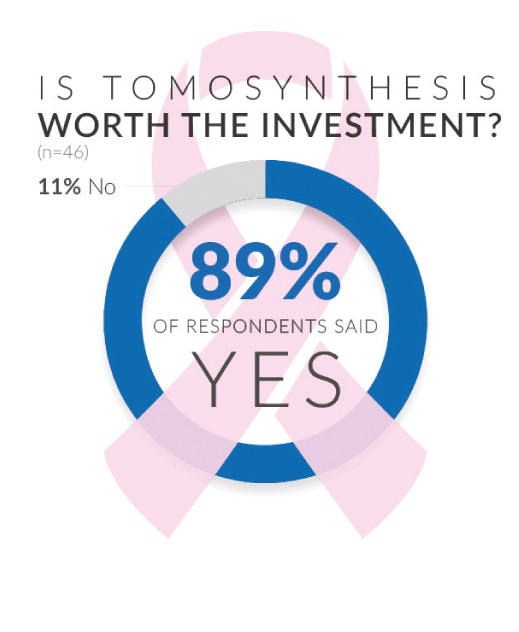

Reimbursement is top of mind for the future and almost everyone we spoke with was surprised Tomo is still a mixed bag on reimbursement. Providers across the board feel it makes a difference so the majority of those we spoke to said they would absolutely buy Tomo again- despite the uncertainty with reimbursement.

Bottom line, what determines an equipment purchase – cost, quality or flexibility?

Quality. For Tomo, most providers we spoke with said they felt like they needed to get it to be competitive. Once they had it, many were converting other units over to Tomo because they could see it was making a difference. If a provider has a 2D unit that can be upgraded it does help with cost as they do not need to purchase a full net new unit.

The full report by Monique Rasband, Tomosynthesis 2016 Can GE Healthcare and Siemens Compete with Hologic? Is available at klasresearch.com.