HealthManagement, Volume 5 / Issue 2 / 2010

Authors:

Stephen Wright

Executive Director,

European Centre for Health Assets & Architecture.

Bernd Rechel

is a Researcher at the European

Observatory on Health Systems & Policies and Honorary Lecturer at

London School of Hygiene & Tropical Medicine.

Martin McKee

is Professor of European Public

Health at London School of Hygiene & Tropical Medicine and Research

Director at the European Observatory on Health Systems & Policies.

James Barlow

is Director Health & Care

Infrastructure Research & Innovation Centre and Professor of Technology

& Innovation Management at mperial College London

Florence

Nightingale once noted that ‘hospitals are only an intermediate stage of

civilization’. She was looking at an institution and its buildings which were

immensely different from what we have today. And 150 years from now, the

hospital will presumably have changed just as dramatically as the current

hospital is distant from that of the midnineteenth century. There is an

inference to be drawn from how strange her quote appears to us, in an

environment where the hospital is the epitome of civilisation: it is

conceivable that we have now gone all the way from contempt for the hospital to

idolatry of it. It is worthwhile instead spending a little time deconstructing

the role of the hospital in the delivery of healthcare.

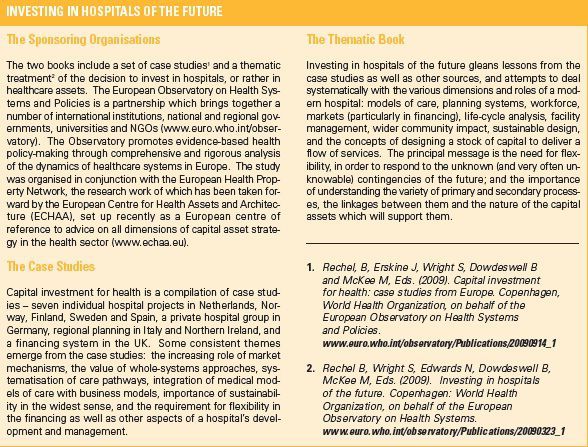

In the past year, the European Observatory on Health Systems and Policies has published two sister volumes on the issues of capital investment in hospitals in Europe (see Box). This article highlights key aspects of the study – the encroachment of market principles into what is still largely a public sector-dominated activity; the financing models being increasingly used; and the relationship of patient flows to physical capacity.

There is an inherent paradox in reviewing hospital projects. Given the timescales for hospital development, if a facility has been running long enough for it to have settled down and be generating evidence about its performance, it must have been conceived more than a decade before, and cannot represent state-of-the art any longer. If, on the other hand, it embodies latest thinking, then it cannot yet have been tested in the real world. While there is no absolute way round the oxymoron of a proven modern hospital, carefully dipping into the stream of evidence provides suggestions about the direction of travel.

The Impact of the Global Economic Crisis

At present, the world (the West in particular) is suffering from the worst economic recession since the Great Depression of the 1930s.

Adding to the problem is the fact that the recession overlaps with an incipient ageing crisis. This is both a healthcare and a pensions problem. Governments are certain to spend at least the next decade struggling to pay down high levels of debt while simultaneously increasing expenditure as baby boomers retire. This might expose health system spending to cutbacks.

Broadly speaking, Western governments will have to shift overall spending by about 5 percent of GDP to reverse existing fiscal deficits, 5 percent to pay down legacy debt and 5 percent to rebalance spending towards the ageing. 15 percent of GDP is a massive switch of spending priorities. In this light, one obvious, and favoured, response by governments will be to cut capital investment, including that in the health sector. However, this would be a mistake, as ageing capital assets are unlikely to provide the best environment for innovative healthcare. The current economic circumstances, then, make wise investment choices in healthcare even more important – and more difficult - than before.

‘Marketisation’

It may sometimes appear that the introduction of market forces into healthcare is inevitable and uni-directional, as with other sectors previously dominated by government. However, this ignores history, as the immediate post-war period saw many sectors nationalised in western Europe precisely because private ownership was perceived to have failed. Moreover, the concept of market competition is ambiguous and confusing. For instance, does competition mean price competition, or is it sufficient that providers compete for volume contracts with uniform prices set by a central regulating body. Does it imply profit-making medicine? What is the scope of competition? Does it apply to all forms of hospital care or primarily to a few elective (non-acute) services?

In fact, market competition involves multiple developments in hospital care. It may be brought about by a government policy that is explicitly directed at creating competitive relationships. Pro-competition reforms are intended to increase the efficiency and innovativeness of hospital care, to improve its quality and make it more patient-oriented. Examples of these reforms are the introduction of competitive bidding models or the elimination of barriers to entry into the hospital market by new providers. Developing hospital information systems to support perform ance measurement, with the goal of improving the quality and efficiency of hospital care, fits perfectly within a market reform, because information is also a precondition for informed choice and more effective management and competition by providers. Furthermore, it would be wrong to view market competition only as the result of central government reforms. The picture is more complicated. ‘Bottom-up’ initiatives by private providers or local governments to provide services in new settings, such as those using remote patient monitoring technologies, or moves to privatise public hospitals, may also elicit competition.

Wide Range of Changes in Hospital Care

However, there have been various changes in hospital care: in the public-private mix; the role of new entrants; the reform of arrangements for funding; the introduction of new models of capital investment; and the development of information systems measuring hospital performance.

The public-private mix of healthcare delivery is diverse: France has substantial provision of elective care by private clinics; Germany has many not-for-profit hospitals and an increasing number of for-profit hospitals; in many countries with national health services, the share of private groups of any kind remains relatively low. But policy-makers in some countries are seeking to convert hospitals into private agencies through privatisation, and correspondingly to introduce competitive mechanisms into public sector provision. It is not clear whether the underlying belief that private for-profit hospitals are more efficient is correct; most economic research in the US market indicates this is not so. Indeed, several recent studies of the German hospital sector seem to corroborate that, even when corrected for quality, public hospitals are more cost-effective than the private sector.

Most hospitals in Europe are general hospitals offering a wide range of acute and elective care services. A recent development has been the rise of new providers that are mostly private single-specialty organisations delivering routine hospital care, in an ambulatory or stand-alone setting, such as the ‘independent treatment centres’ in the United Kingdom. This may be coinciding with splitting hospitals, even tertiary facilities, into multiple single-purpose ‘factories’.

Hospital funding, mostly recurrent, is also changing. There is a strong trend away from global budgets towards case mixbased funding. While not a market reform in itself, it is a precondition for market competition. Diagnostic-Related Groups (DRGs) and the like do, however, have certain problems. The systems tend to be complex and have unintended consequences. Health insurers are not yet able to function as a countervailing power in price negotiations with dominant hospital provide. There is a lack of transparency and comparable data, even for yardstick competition. And finally, it is not clear that, as prices, DRGs are either appropriate in every-day resource management use (given the growing importance of chronic disorders for which episode-based measures are of limited relevance) or, in particular, give the right signals with respect to new capital investment.

Hospital performance information is not only an instrument to inform stakeholders but also a tool to improve the efficiency and quality of hospital care. Initiatives invariably cover quantity, cost and productivity measures. It is also worth noting the increasing use of quality indices, such as the Patient-Reported Outcome Measurement – the patient’s perception of the degree to which they felt better after treatment – now being rolled out in the English NHS.

Financing Models: State

Within the health systems of Europe, where financing and provision are dominated by the public sector, most of the financial resources are ultimately supplied by the state. Traditionally, with respect to capital investment in new or upgraded facilities, this was by means of something called public sector ‘equity’ – which bears, however, little resemblance to its private sector equivalent in that the value of the estate often did not need to be accounted for nor a financial return delivered to the shareholders. Public sector debt in principle introduces more discipline, though often where there is a so-called soft budget constraint, there are no sanctions for overspending.

EU Structural Funds: Member States

A new source of capital funding, which is particularly applicable to the new member states of the European Union, consists of ‘Structural Funds’, grants used largely for regional development. The majority of this funding is applied to transport, energy and environmental infrastructure, but in the current 2007-13 programming period it is thought that up to 5 percent of the total 347 billion euro may be used in the health sector. Projects and programmes go through an elaborate approvals procedure, from the EU through national down to local level. As a result of eligibility criteria, most funds will be focused on relatively poor areas, where they could well account for a substantial proportion of healthcare capital expenditure in coming years. The impact of this spending, and the degree to which its availability biases the choice of projects, are as yet unknown (see www.euregio3.eu).

Public-Private Partnership (PPP)

An encroaching concept for capital spending is the Public-Private Partnership (PPP) instrument. Concessions of one kind or another have been used for many years, and have included the health sector. However, the modern use of PPPs has expanded greatly with the UK’s Private Finance Initiative (PFI). In a PFI hospital project, the hospital trust lets a contract for construction or redevelopment of accommodation on a site (sometimes including medical equipment), with the facilities leased from the private sector for up to 35 years.

The contractor designs the hospital according – in principle – to an output (not input) specification set by the public sector, raises the finance, arranges for construction, and carries out the ‘hard facilities maintenance’ (and sometimes other maintenance) during the contract life. The facilities are returned to the hospital trust at the end of the term. In return, the contractor is paid a monthly unitary charge, offset by penalties for any unavailability of space or reduced standard. Apart from the in the countries of the UK, variants of this model are used in France, Spain and Portugal.

The accommodation-only PFI model is complemented by others. One example has a clinical services company, paid mainly by volume of activity, operating alongside the infrastructure company (this scheme is used for some hospitals in Portugal). Some of the hospital privatisations in Germany amount to a concession, where a private company takes over a failing public hospital and operates it as a licensed facility within the region’s public hospital plan (i.e. there is no cream-skimming of patients, but otherwise operational freedom exists). Similarly, there are arrangements in Spain where a company operates a full hospital concession but in addition runs the community care facilities in an area, and is reimbursed not by performance fees for the sites but rather through a capitation payment (that is, a fee per member of the regional population). This is effectively a version of the Health Maintenance Organisation framework used in the United States.

All of these PPP models attempt to incentivise the performance of the private sector contractor by the bundling of responsibility for the capital costs together with the recurrent costs – certainly at the level of the building (PFI), but sometimes additionally with other more general recurrent costs including hospital medical services or community services. There are pros and cons of each model, with the prime difficulty arising from the tendency for the private partner to capture the tangible (cost reduction) benefits of the contract while leaving the public sector hospital authorities struggling to ensure quality or to adapt the facilities to changes in medical provision over the very long durations in the contract.

Flowing from Capacity

Hospitals often appear to be black boxes – their complexity is so great, and the interests of those who work in them so entrenched, that it is very difficult to undertake reform. They are usually organised by specialty (cardiology, rheumatology etc.) or by body system (such as Ear, Nose & Throat) or by population group (e.g. mother & child). One issue is that many of these categorisations can fail to match the way that patients present, and this is an increasing problem with an ageing population where people often have multiple co-morbidities. Further, they tend to crystallise current ways of working, and the continued allocation of resources to fiefs within the establishment.

One way of trying to lever open the black box is to view the hospital as a flow system, relating these flows to the capacity accordingly needed. This leads fairly naturally to considerations of ‘lean’ thinking, and operational research concepts.

In manufacturing, two broad types of work can be distinguished – batch and flow. In batch processing, work is episodic, and individualised by a craftsman through to completion; the result is unique. Much, and possibly too much, medicine is arranged in this fashion, and doctors quite like it this way. Flow processing is systematised and made as uniform as possible. Modelling techniques are available, such as queuing theory, which help to understand where the choke points are in a system (relieving such a blockage will enable the system to operate more efficiently, though it will inevitably bump up against a constraint somewhere else).

The model of care for a hospital which is maximising the proportion of its activities treated as systematic flows would incorporate so-called integrated clinical care pathways (ICPs), extending as appropriate beyond the hospital into community or home care. ICPs can only be efficiently applied with good IT functionality, for transfer of patient information across the boundaries in the system. Lean production notions highlight the paramount need to reduce wasted resources; one of the prime manifestations here is wasted time, and notably hospitals treat patients’ time as essentially free. Patients – they are well-named – wait: in waiting rooms, consulting rooms and wards or bedrooms.

Indeed, in terms of their capacity, hospitals are invariably characterised by the numbers of beds, as though ‘the bed’ is the critical resource which determines the functioning of the establishment. In the light of the queuing theory reasoning given above, this is most unlikely, though it could happen in certain special circumstances. Hospitals only exist because of economies of scope: the idea that functions are better delivered together than separately, such that the additional costs of management created by complexity are less than the benefits of the synergies gained.

Traditionally, it is accepted that medical care is provided alongside research and education and training, but the scope idea goes further than this.

The hospital can be deconstructed into its processing components. Our thematic book includes analysis carried out by the Dutch organisation TNO called the ‘layers’ model. Certain parts of the hospital are ‘signature’ medical ones – operating theatres, imaging, and intensive care; these are capitalintensive and short-life, and can be described as the ‘hot floor’. There are facilities more akin to offices than pure hospital functioning (reception areas, consulting rooms, lecture rooms). Other areas are ‘factory-like’, such as diagnostics, support facilities including laundry and catering, and research facilities. Finally, wards and bedrooms are essentially hotels. Interestingly, offices, factories and hotels within the hospital need not be constructed to the same standard as the hot floor, and as parts of the estate may well be old without unduly jeopardising the fundamental medical delivery of the hospital. The mapping of different flows against the various sorts of capacity offers a possibility of reconceptualising the hospital.