HealthManagement, Volume 16 - Issue 1, 2016

Enterprise imaging — the ability to store, view and exchange images from multiple service lines — promises to revolutionise the imaging landscape as growing demand for improvements in diagnosis and treatment is adding pressure to enable and simplify image exchange across the board.

Yet many providers, especially large hospitals and integrated delivery networks (IDNs) are still uncertain on how to move forward, as many do not realise the interoperability potential and often under-utilise their medical image sharing networks.

For its annual performance report, Enterprise Imaging 2015: Strategies, Options and Vendor Performance, KLAS research interviewed 92 providers, who have a clear enterprise imaging strategy, to find out how these early adopters are planning and implementing their enterprise imaging IT strategies and how well vendors perform in an enterprise imaging setting.

KLAS also explored which organisations are employing a consolidated, integrated enterprise imaging approach with a single vendor (or fewer vendors) and which organisations are adopting a best-of-breed strategy.

While many providers have adopted a vendor-neutral archive (VNA), a universal viewer, an image exchange or other technology associated with enterprise imaging, these pieces are often not used as part of a defined enterprise imaging strategy

Centralised Approach Most Popular

Most providers implementing an enterprise imaging strategy adopt a centralised approach, using a VNA as the foundational piece of technology. Advantages of this approach include cost reductions and deeper interoperability (41% of responses), although few have seen cost reductions today. other providers opt for a federated approach built around a universal viewer (18%). Providers who use this approach say continuity of care is improved and clinicians are more efficient. satisfaction for both groups of providers is high, and neither approach stands out as more effective than the other.

No Comprehensive Solution Exists

PACS vendors offer key enterprise imaging solutions, including VNAs, universal viewers and image exchange, but there are gaps around specialty-specific functionality, analytics and enterprise content management. No single vendor offers a complete enterprise imaging portfolio, although Agfa HealthCare, GE Healthcare, and Merge come close, with Merge standing out for widespread adoption and consideration.

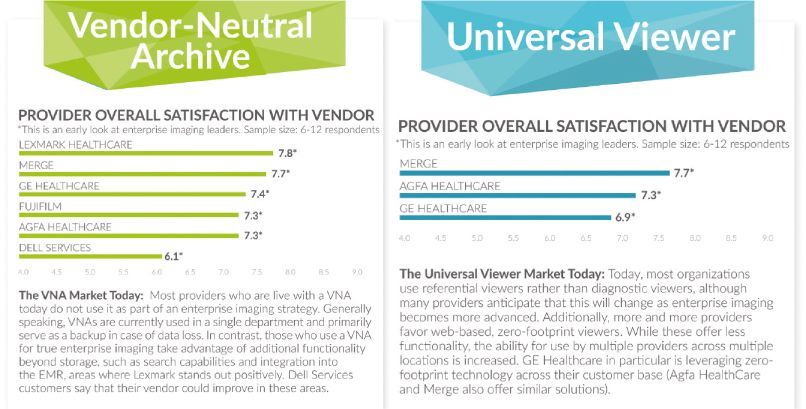

Generally, VNAs are used in a single department and primarily serve as a backup in case of data loss. In contrast, those who use a VNA for true enterprise imaging take advantage of additional functionality beyond storage, such as search capabilities and integration into electronic medical records (EMRs), areas where Lexmark stands out positively. Dell Services customers say that their vendor could improve in these areas. In addition, Lexmark, GE, Merge and Fujifilm have live sites for VNAs, with Philips, Dell and Agfa having future VNA plans under consideration.

Web-Based, Zero-Footprint Viewers

As regards universal viewers, most organisations use referential viewers rather than diagnostic viewers, although many providers anticipate that this will change as enterprise imaging becomes more advanced. More and more providers favour web-based, zero-footprint viewers. While these offer less functionality, the ability for use by multiple providers across multiple locations is increased. GE Healthcare in particular is leveraging zero-footprint technology across their customer base (Agfa HealthCare and Merge also offer similar solutions). Vendors with contracted universal viewer plans include GE, Fujifilm, Terarecon, McKesson and Lexmark, while Merge, Agfa and Calgary Scientific have future universal viewer plans under consideration.

The medical image exchange platform lifeIMAGE is highly considered by providers hoping to adopt an image exchange solution. Providers praised lifeIMAGE for their experience with large organisations and consistent development. Other frequently mentioned image exchange vendors included Agfa HealthCare, DICOM Grid, Merge, and Nuance.

The full report, by Monique Rasband, Enterprise Imaging 2015: Strategies, Options, and Vendor Performance is available at klasresearch.com.