HealthManagement, Volume 13 - Issue 1, 2013

Wireless to Become Integral to X-ray Technology

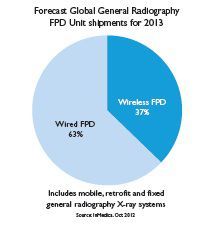

InMedica predicts that wireless flat panel detector (FPD) general radiography X-ray equipment will make up over 30 percent of unit shipments in 2013.

Increased adoption of PACS & VNA Managed Services

Managed service models accounted for around 8 percent of total radiology PACS revenues in 2011 worldwide. InMedica forecasts that revenues from managed service models will grow to around 12 percent of the total in 2013, with almost a quarter of those involving a model where the vendor hosts images in an off-site datacentre.

With decreasing healthcare budgets and hospitals under increasing pressure to reduce storage costs, enhance access to data and improve productivity, managed services (a model where a vendor owns the IT infrastructure and is responsible for managing and hosting the software and data centre), are increasing in demand. These models are being adopted as a method of increasing the level of vendor services, whilst reducing storage and application costs.

Hybrid and hosted managed service models can offer significant reductions in storage and maintenance costs users only pay for storage used and the vendor is responsible for the majority of service provisioning. However, these models are restricted by concerns over performance and security, as well as by poor bandwidth to transmit data to offsite locations in less developed geographies. Concerns over performance include the ability of the application to provide continuous uptime and instant access to data that is located off-site, without compromising image quality.

There are regional variations in demand, with the US and UK having more open vendor-hosted models, while Germany and many Asia Pacific countries enforce stricter data security regimes.

Even higher adoption is projected in the vendor neutral archive (VNA) market, with managed service models projected to grow to 24 percent of worldwide revenues in 2013. Most of these revenues will be from hybrid models where one instance of each image is remotely hosted.

European Medical Device Market Performance To Worsen in 2013

Obama Care to Have Mixed Effects on Healthcare Markets

- Healthcare IT is projected to strongly benefit from increased adoption of electronic medical records (EMR), clinical information systems (CIS) and hospital information systems (HIS) to effectively manage patient throughput, reduce duplication costs and achieve meaningful use.

- Solutions that facilitate data access sharing and exchange between facilities, such as Health Information Exchanges (HIE), Patient Portals and Vendor-Neutral Archives (VNA) are also projected to achieve strong growth.

- The telehealth market is projected to benefit as hospitals and Accountable Care Organizations (ACOs) seek to manage their increased patient populations, reduce inpatient costs and readmission penalties.

- As the importance of integrating patient data into the EMR increases, it is becoming a key factor in new purchases of clinical care devices.

Negative Effects

- Imaging utilisation rates for advanced imaging modalities (CT and MRI) will increase substantially with reimbursement penalties for those that do not adhere.

- Increased patient load and burden on existing services.

- Per-capita healthcare expenses will slowly increase throughout the year.

- The likely introduction of a 2.3 percent medical device tax is projected to drive up prices and negatively affect of hospital spend on medical devices. Manufacturers have also indicated its potential adverse effect on the total costs to bring devices to market.

For more information see InMedica 10 Predictions for 2013 in the Medical Electronics Industry http://bit.ly/13a95qE