The last 3 years have been very difficult times for healthcare organisations

as they have faced and dealt with the challenges of COVID-19, supply chain

disruptions, and staffing problems. The 2022 Digital Health Most Wired

survey, conducted by CHIME, shows how facilities are increasingly turning to

digital tools to address infrastructure, security, administrative/supply chain,

analytics/data management, innovation and other clinical and business areas.

Key Points

- The 2022 Digital Health Most Wired (DHMW) survey,

conducted annually by the College of Healthcare Information

Management Executives (CHIME), shows how facilities turned

to digital tools to address several challenges in the recent

years, including the impacts from COVID-19.

- 18 U.S. acute care organisations and 17 U.S. ambulatory

organisations achieved the highest level of recognition. Many

of them implemented advanced technologies, but they often

leverage these technologies in innovative ways and have

encouraged deep adoption across their entire organisation.

- Across the survey’s nine sections, there are numerous of

findings that show not only how care delivery organisations are

rebounding from the crises of the past several years but also

how they continue to advance their digital health agendas.

Results from 2022 Digital Health Most Wired

Survey Show Digital Trends

Healthcare delivery organisations have faced a

combination of historic global challenges over the past

several years: pandemic, supply chain disruptions, and

high inflation. These challenges have impacted clinical

and business operations with a variety of outcomes and

consequences.

These impacts are evident in the 2022 Digital Health

Most Wired (DHMW) survey, conducted annually by

the College of Healthcare Information Management

Executives (CHIME). This survey represents over

38,000 facilities from 10 countries, primary from

the United States (U.S.). Those providers include

organisations that serve patients across the continuum

of care: acute care, ambulatory care, and long-term/

post-acute care.

This year, 18 U.S. acute care organisations and 17

U.S. ambulatory organisations achieved the highest

level of recognition, Level 10. In addition to meeting the criteria for levels 1–8, organisations at level 9 or 10

are often leaders in healthcare technology who actively

push the industry forward. Not only have many of them

implemented advanced technologies, but they often

leverage these technologies in innovative ways and

have encouraged deep adoption across their entire

organisation. As a result, they are realising meaningful

outcomes, including improved quality of care, improved

patient experience, reduced costs, and broader patient

access to healthcare services. Some of the advanced

technologies used to achieve these outcomes include

telehealth solutions, price-transparency and costanalysis tools, access to data at the point of care, and

tools to engage patients and their families throughout

the care process.

Particularly related to the COVID-19 pandemic and

resulting supply chain disruptions, the survey reports

a historically high number of facilities achieving the

highest level of recognition (Level 10) in the areas of

Administrative & Supply Chain and Clinical Quality & Safety as care delivery organisations rebound from this

double hit.

Real-time insight into supply chains, product inventory,

and bed/exam room tracking is important, but the

criticality of such insight became evident over the past

several years. As a result from the disruption of supply

deliveries, unprecedented demand for clinical supplies,

and skyrocketing emergency care demand, real-time

monitoring became a paramount concern. Significant

increases were reported by the DHMW survey in the

use of bed/exam room tracking and patient-flow software

systems as compared to 2021. Among intensive care units,

an area especially hard hit by the pandemic, such tracking

system use increased by 11% over the previous year.

Bed/Exam Room Tracking or Patient Flow Software

The unprecedented patient demand, especially in the

areas of emergency and intensive care resulting from

COVID-19 related illnesses, also impacted the extent to

which care delivery facilities utilised digitally integrated

clinical tools. Digitally integrated surveillance systems

in the areas of monitoring patient vitals, monitoring test

lab results, monitoring medication administration, and

monitoring of other clinical information all increased by

20% or more over the past year.

Surveillance System integrated with EHR

These results provide two important takeaways.

First, leveraging digital technology to make the right

information available to the right people when needed

continues to be a key information technology objective.

Second, the extremely high demand for clinical care for high-risk patients further increased the imperative to

have digital tools integrating care into record keeping on

a real-time basis. Between the high demand and staffing

shortages, digitally supported care is critical to clinical

quality and safety.

Across the survey’s nine sections, there are numerous

of findings that show not only how care delivery

organisations are rebounding from the crises of the past

several years but also how they continue to advance

their digital health agendas. Areas ranging from

wireless technology to analytics & data management

to patient engagement show further adoption of digital

technologies.

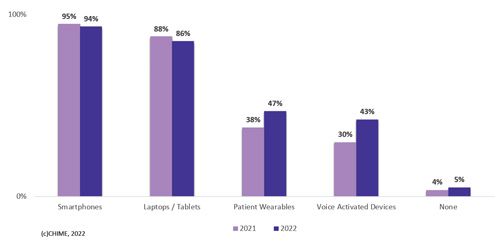

Infrastructure trends reported in the 2022 DHMW

survey show significant year-over-year increases in

mobile point of care devices (+9%) and traveling profiles

(+8%) as the demand on clinical staff rapid response

intensified during the pandemic and was exacerbated by

clinical shortages. Furthermore, use of employee-owned

devices for patient care has become near ubiquitous

with 94% of facilities allowing use of employee-owned

smartphones and 86% allowing use of employee-owned

laptops/tablets for patient care.

Adoption of Employee-Owned Devices in the Use of Patient Care

As widely promoted in trade show exhibitions and

vendor advertisements, data analytics has been viewed

as a growth area in health information technology. In

fact, the survey does show significant growth in the use

of near real-time analytics and in the delivery of data to

clinical leaders. However, there is also evidence of gaps

in adoption and level of sophistication.

Foundational components for clinical and business

analytics, enterprise data warehouses (EDW) or

operational data stores (ODS) exist in 94% of the

responding facilities for their clinical and business

intelligence efforts. But what is housed there varies:

69% send supply chain/ERP data to the EDW or ODS

while only 39% send CRM data there. The survey

also found that clinical quality metrics were the most

commonly delivered for real-time analytics while only

45% delivered data related to social determinants of health.

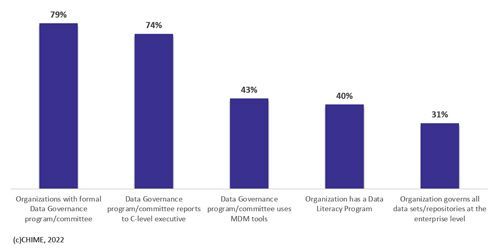

Style of data governance and use of data

governance tools provide an insight into the level of

data management sophistication for care delivery

organisations. While 79% of respondents have

established a formal data governance program/

committee, just 43% of them use master data

management tools and only 31% govern all data sets/

repositories at an enterprise level. This illustrates the

evolution still ahead for most care delivery organisations.

Adoption and Execution of Data Governance Program

Not surprisingly in this pandemic era, digital tools to

remotely connect and engage with patients show some

of the largest increases reported. Increasingly, care

delivery organisations are creating dedicated digital

officers to drive their digital health strategies which are

often focused heavily on engaging patients outside of

the facility. The survey reported 16% increases in the

use of patient/family facing videos to educate patients

and to share lab and test results and an 11% increase

in such videos to address medication prescriptions and

related matters.

Conversely, as the 2020 and 2021 hospitalisation

spikes were replaced by somewhat smaller spikes in

2022, telehealth visits among reporting facilities declined

by nearly 6% to just 13% of total visits. Particularly in

the United States where payment methodologies may

influence visits, there remains much to be done to drive

care to the most effective, most efficient, and most

convenient locus of care.

A new section to the 2022 DHMW survey focused on

innovation. Investments in new technologies and digital

solutions are clear drivers of innovation. While the ability

to pursue such investments is affected by the resources

available for such purposes, nearly all reporting

organisations (96%) are looking to drive clinical

innovation through investment in these solutions. More

than 23% of all reporting organisations expect to spend

10% or more of their IT spend on experimentation/trials

of technological innovation, new ideas, ventures, and

related solutions. This illustrates not only how important investing in innovation is but also how many are

aggressively pursuing these strategies to improve their

ability to deliver care and achieve optimal outcomes.

So where does this level of investment put health

care organisations on their transformational journey?

Sixty-eight percent report they are on or ahead of

their schedule in their digital transformation execution,

compared to plan with the biggest challenges to

realising a successful transformation being a lack

of dedicated budget (20%), cultural resistance

(15%), tendency for short-term planning over longterm planning (12%), and an over reliance on legacy

technology (11%).

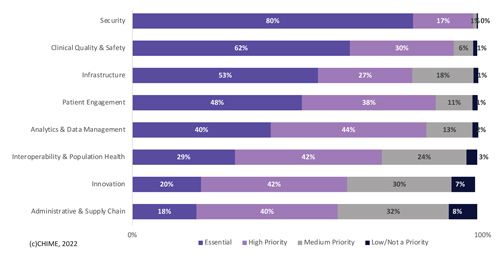

Organisational Priorities for 2023

Finally, the survey also asked participants to identify their organisational priorities for 2023. The highest

reported priority, with 97% classifying this as an

essential or high priority, was security. This was followed

closely by clinical quality and safety with 92% rating this

area as an essential or high priority and the third most

important priority for 2023 by these respondents was

patient engagement at 86%. All are consistent findings

with expectations held by most and despite heavy focus

and investment in these areas over the past few years,

they remain at the top of most priority lists.

The primary survey is conducted each year between

April and June; however, organisations may contact

CHIME at any time to receive the current year’s survey

instrument and submit their data for scoring.

For more information, go to https://dhinsights.org/

analytics and click on the I Am A New Provider Partner

button. More detail on the 2022 Digital Health Most

Wired survey can also be found in the National Trends

Report which is available at

https://dhix.dhinsights.org/wp-content/uploads/2022/11/2022-DHMW-NationalTrends-Report.pdf.

Conflict of Interest

I am on contract with CHIME as their Chief Analytics

Officer but I have no conflict or derive no financial gain

from the publication of this article