HealthManagement, Volume 24 - Issue 4, 2024

Global healthcare organisations, particularly in Europe, showed increased activity in 2023 in Electronic Health Record (EHR) purchases and implementations. Regional initiatives and investments drove significant decisions, while multiregional vendors like Dedalus and Epic led the market.

Key Point

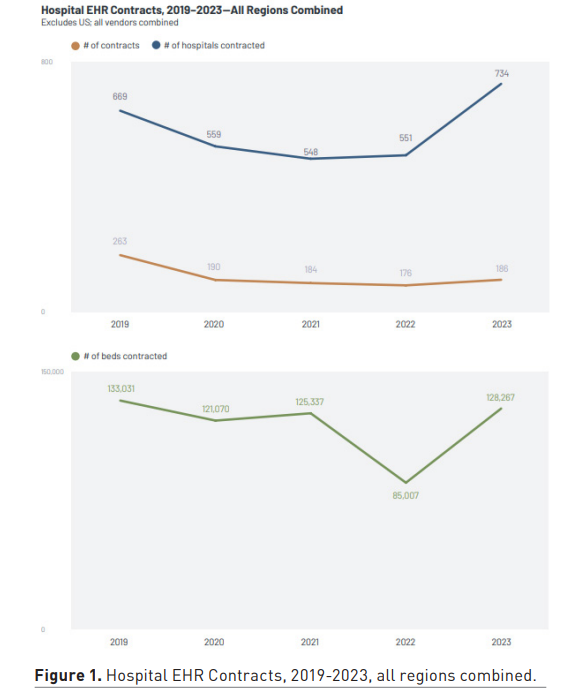

- Global EHR activity surged in 2023, with organisations outside the US making significant EHR purchase decisions that impacted 734 hospitals and over 128,000 beds, marking the highest impact since the COVID-19 pandemic.

- Europe led the global EHR market in 2023, driven by regional investments in healthcare IT infrastructure, with Italy and France showing strong activity and future growth expected in Belgium and the UK.

- Epic secured the largest EHR decision in Oceania, impacting 191 hospitals in New South Wales and Australia, while regions like Latin America and Canada also experienced notable EHR activity.

- Multiregional vendors like Dedalus, Epic, Oracle Health, and MEDITECH dominated larger contracts, with Dedalus leading the market, particularly in Europe, while regional vendors remained strong in local markets.

- Global EHR purchase energy is expected to continue rising in the coming years, fuelled by government initiatives and investments, with KLAS tracking trends and market share across all regions.

Across the world, healthcare organisations are continuing to prioritise EHR initiatives, whether they be purchase decisions, implementations, extensions, or optimisations. From January 2023 to December 2023, organisations outside the US made EHR purchase decisions that impacted many hospitals—the highest since the start of the COVID-19 pandemic. In the recently published Global EHR Market Share 2024 report, KLAS examined this trend and others within the following regions: Africa, Asia, Canada, Europe, Latin America, the Middle East, and Oceania.

Which Markets Have the Highest Energy?

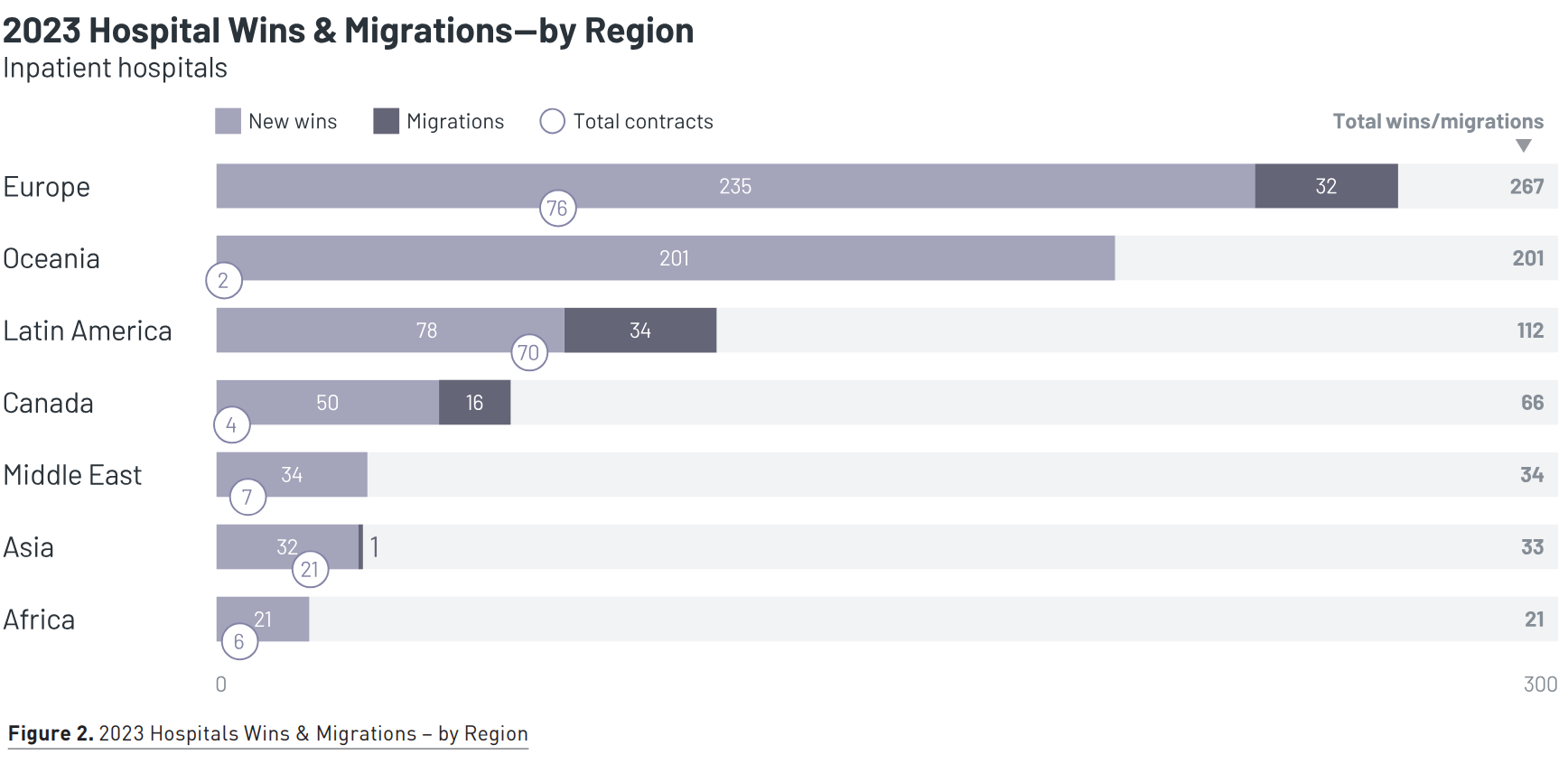

In 2023, KLAS validated 186 EHR purchase decisions (net-new wins and migrations) across these vendors that impacted 734 hospitals and over 128,000 beds. As previously mentioned, the number of hospitals impacted by global EHR decisions reached a five-year high. However, the total number of finalised decisions in 2023 was slightly below that of past years. Europe is the most active region in terms of total EHR contracts and the number of hospitals affected. Regional investments are driving this energy to modernise healthcare IT infrastructure, specifically in Italy and France. In the coming years, we will likely see increased activity in Belgium and the UK due to regional convergence strategies.

Although only two EHR purchase decisions were finalised in Oceania, this region had the second most impacted hospitals after Europe, thanks to a significant decision in New South Wales, Australia, impacting 191 hospitals. This decision—the largest KLAS validated for 2023—was finalised in favour of Epic. More purchase decisions will be finalised in Oceania in the next few years. Additionally, 2023 was a fairly active year for Latin America, Canada, and Africa. Purchase energy was slower in both Asia and the Middle East (though KLAS currently has limited visibility into EHR purchasing in parts of Asia, such as China and India). Government initiatives and investments will likely continue to be a driving force in purchases across the globe.

Which EHR Vendors Are Selected Most Frequently?

KLAS tracked EHR decisions for 46 vendors and validated decisions recently finalised in favour of 28 different EHR vendors throughout 2023. To provide more detail for readers, this report breaks out the vendors into the following two groups: multiregional and regional. Around two-thirds of the 186 contracts validated in 2023 involved a regional vendor; despite this, 68% of hospitals were impacted by multiregional vendors, who are more likely to be selected in larger, multihospital decisions.

Among the multiregional vendors, Dedalus was selected in the most decisions, affecting 147 hospitals with over 31,000 beds. The vendor’s most active market was Europe, specifically Italy, and they were also selected in Latin America. Epic had the second-largest number of beds contracted. Oracle Health and MEDITECH had the following most among multiregional vendors and were selected in 10 and 9 decisions, respectively.

Regional EHR vendors with the highest purchase energy include Europe-based CompuGroup Medical (Germany), Hopsis (France), Kranium Healthcare Systems (India), MV (Brazil), and Softway Medical (France). The full KLAS report offers a deeper look at all the vendors selected in 2023 purchase decisions.

Europe

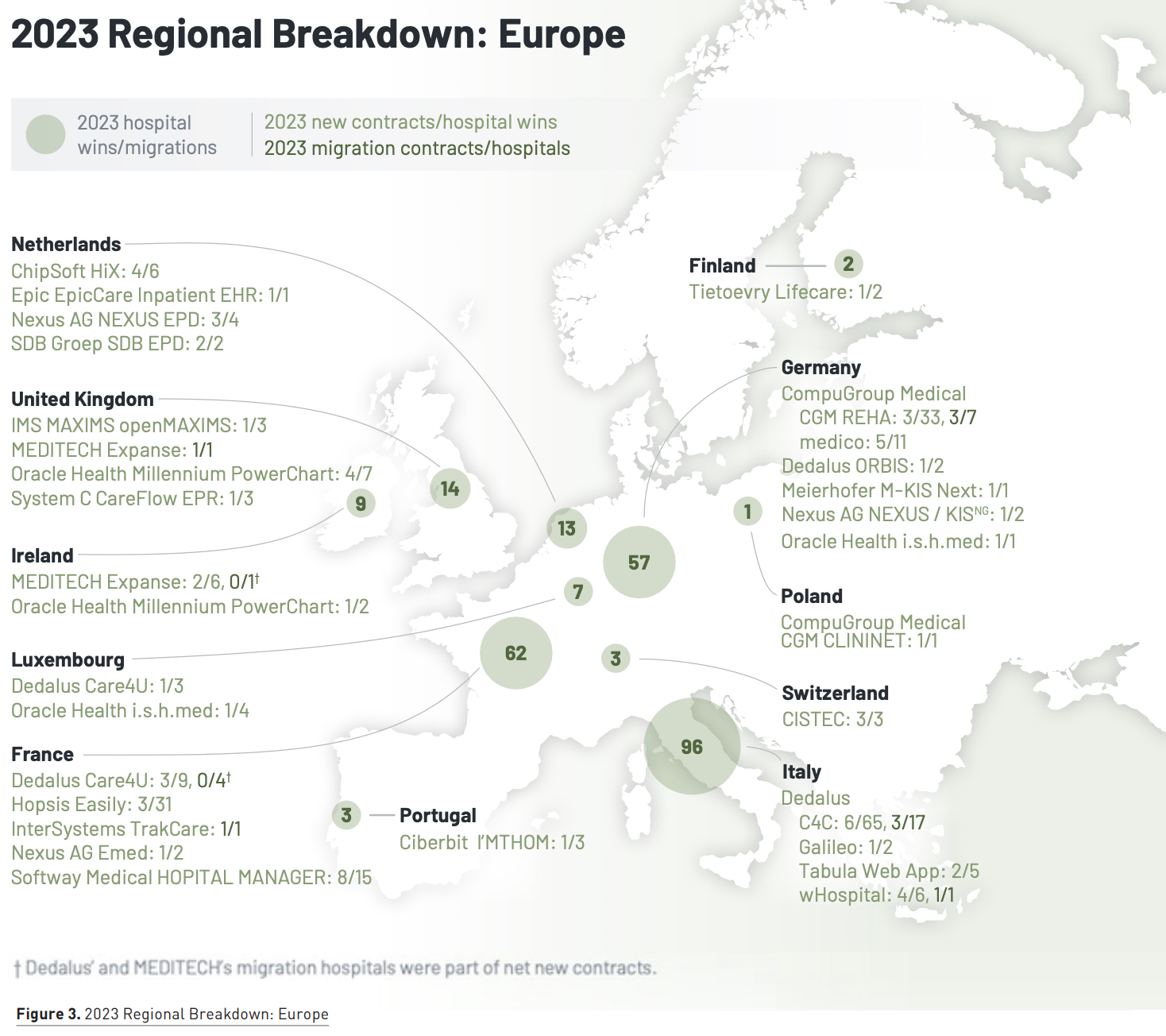

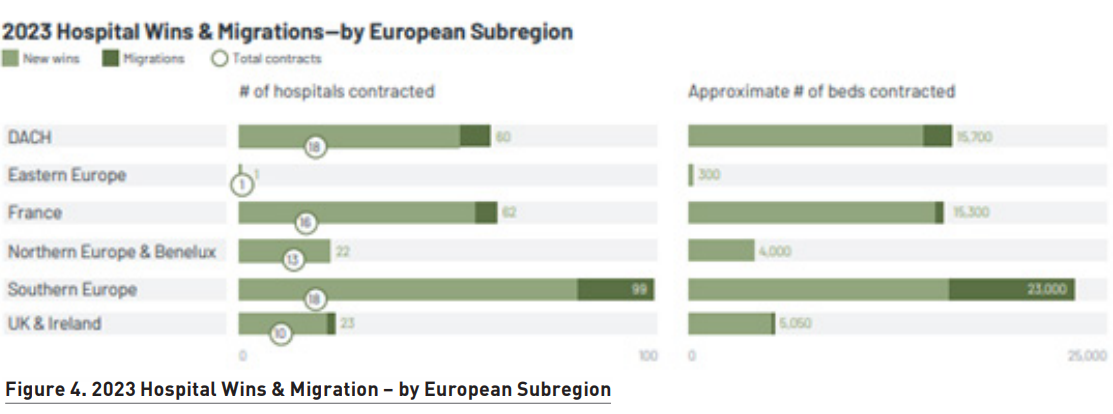

Europe continues to have the most hospital EHR activity. France has been the most active EHR market in previous years, but the market tapered off in 2023. Investment picked up in Italy in 2023 and will continue to ramp up in the UK and Belgium thanks to regional EHR initiatives in the coming years, keeping the region active.

Of multiregional vendors, Dedalus had the strongest year in Europe, benefitting most from the activity in the Italian market and also being selected in France, Luxembourg, and Germany. The other vendors with the most activity in 2023 in Europe are local. CompuGroup Medical’s strong year was driven by two prominent private groups selecting the EHR for rehab hospitals. Several nonprofit groups in Germany also chose medico for their acute care hospitals. Hopsis saw continued growth in their home country, France. One large territorial hospital group (GHT) selected the EHR as their go-forward solution, and two other organisations are consolidating onto the platform. Softway Medical was selected for two GHT contracts—one in France involving a psychiatric hospital group and one in a French Overseas Territory. SIB also won a GHT contract in a French Overseas Territory.

DACH (Germany, Austria and Switzerland)

KLAS validated 18 EHR contracts in DACH countries. While purchase energy slowed down in the region among acute care hospitals, the rehab market was particularly active. In the future, activity is anticipated to increase as Oracle Health i.s.h.med clients evaluate their options and more funding becomes available. Dedalus and CompuGroup Medical have been selected most in recent years in the region and currently stand best poised for future growth.

France

The tail end of the GHT purchasing wave continues to buoy EHR activity. Softway Medical and Hopsis have been the most selected recently, followed by SIB and Dedalus. EHR activity in the French market will likely ebb in the coming years as many of the GHTs will have reached a decision and will be focused on other priorities.

Southern Europe

Significant investment from the PNRR (Piano Nazionale di Ripresa e Resilienza) program has driven a large portion of EHR activity in Italy, which will continue to be high in the coming years. Dedalus (with 3+ solutions available in the market) is the most widely selected vendor. In 2023, KLAS validated 17 finalised contracts in favour of Dedalus—most of which are going with the C4C platform. GPI (not covered in this report) was selected as the go-forward platform in Lombardia but also has energy in the region.

Northern Europe & Benelux

Thanks to purchasing energy from rehab groups, the Netherlands was the most active country across Northern Europe and Benelux. ChipSoft, the predominant EHR player in the acute care market, was selected the most. Going forward, Belgium will likely be the hub of EHR activity in these countries as regional hospital networks look for go-forward platforms. There is also a significant EHR decision that should soon be finalised in Stockholm.

UK & Ireland

Decisions in England ramped up in the past year. Although EHR consolidation across integrated care systems has been a frequent topic of recent conversation, most finalised decisions in 2023 were made by trusts that had no enterprise EHR in place. Multiregional vendors, like Oracle Health and MEDITECH, were selected the most in 2023 and are positioned to grow the most in the future alongside another multiregional vendor, Epic. A local vendor, System C, has the most energy out of the local suppliers. In addition to purchasing among public trusts in England, the Irish market should also see increased activity.

What’s Next?

Global EHR purchase energy has gradually increased since its pandemic-induced decline, and it will likely continue to rise in the coming years as healthcare organisations finalise decisions and as government programs invest in EHR purchasing. As KLAS publishes this report year after year, they remain committed to uncovering trends in EHR purchases and providing transparency into global market share.

KLAS encourages healthcare organisations worldwide to read the report, which provides detailed breakdowns of activity in each global region, high-level market share data for validated vendors, and purchasing trends since 2019.